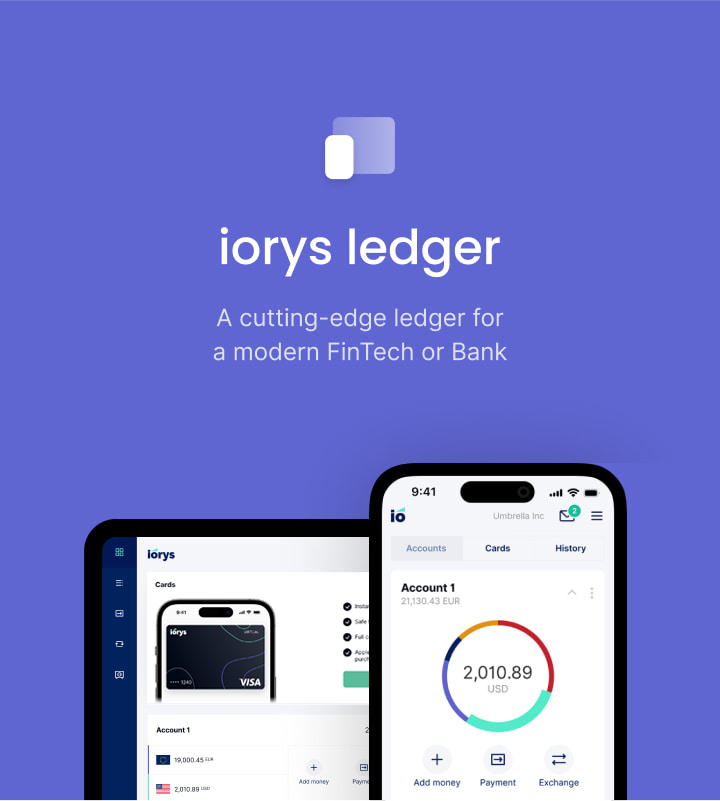

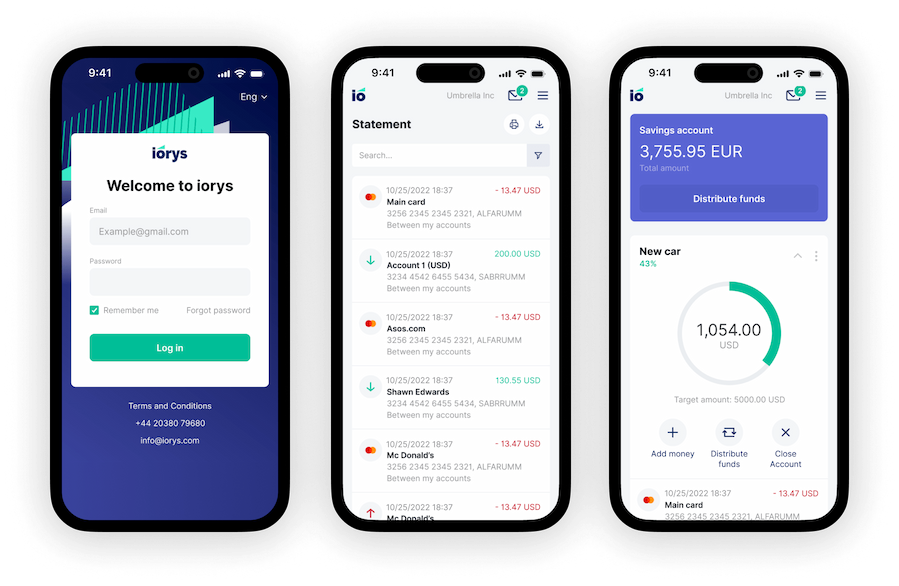

iorys Front

A front-end that contains an online and mobile

client portal

client portal

Ready-to-use

white-label online and mobile banking with a remarkable UI/UX intuitive interface

Quick rebranding using your corporate style or creation of personalized design based on your needs. The front office is operational both as an integral part of iorys core platform, and as a stand-alone application for any 3rd party platform. Any other front-office can be connected to iorys platform via an API.

Account loading and withdrawal options

- Bank transfers

- Internal transfers

- Payment cards

- E-wallets

- Crypto-currencies

- Cash

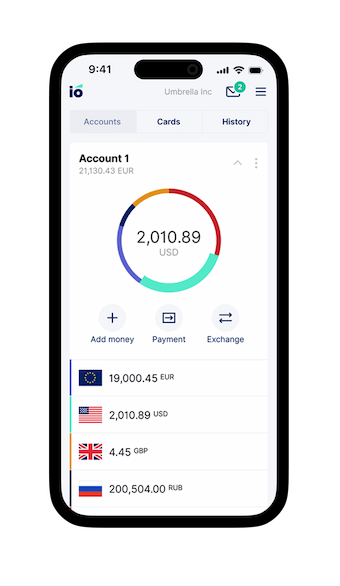

iorys Application

Outstanding user interface and experience, as well as onboarding process for seamless account opening

Two-factor authentication

Choose a variety of 2FA methods for login to Client Portal (both for web and mobile):

-

SMSConfirmation codes by SMS

-

Iorys appPush messages into white-label app (branded under your design)

-

Google AuthenticatorOne-time numeric code generated by the app

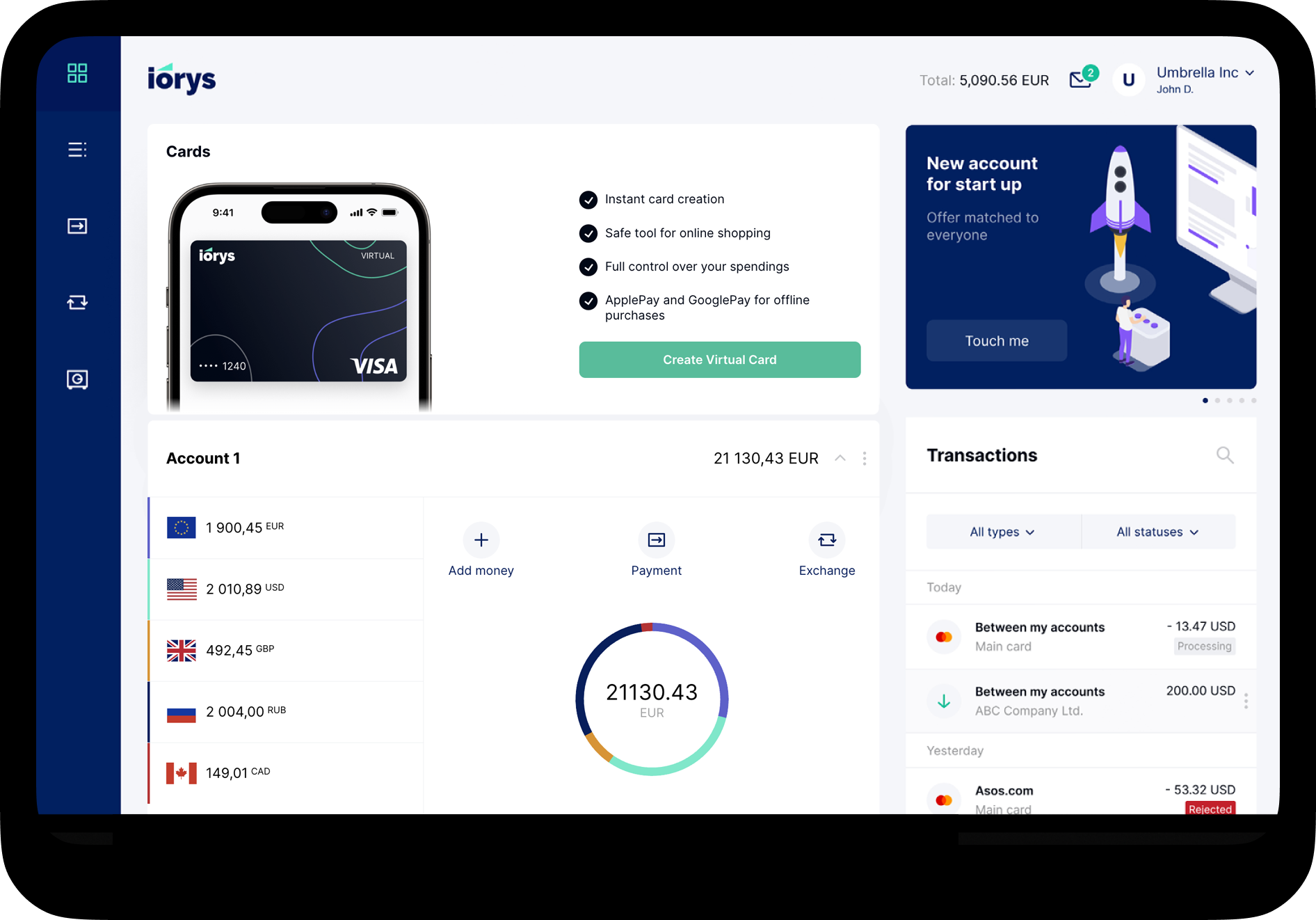

Front-end modules

-

Account statementsMulti and single currency account statements. Search of payments based on dates, amounts, and key words. Download of account statements in PDF/CSV/XL formats. Request for a SWIFT confirmation of any outgoing payment.

-

Internal and external transfersInternal and external payments, creation of templates, programming of payments with deferred dates. Automated IBAN validation and auto-completion of some of the fields (BIC, address, etc.). Request of outgoing transfers with an automated currency exchange. Simplified filling in external payment orders.

-

Transfers via APIExecution of single payments from an external platform (e.g. accounting software) via a secured and encrypted channel. Mass pay-out via an API.

-

Payment CardsOrdering payment cards, activation/blocking, viewing the balance and transaction history, loading the card, setting and viewing a PIN code, blocking/unblocking online payments, ATM or POS transactions. Functionality for External Balance Authorisation allowing to issue multi-currency payment cards.

-

Currency ExchangeCurrency exchange using pre-set rates. Online feed from 3rd party services. View of exchange rates on previous dates.

-

Term DepositsOpening of terms deposits and automatic calculation of accrued interests. Projection of future interests.

-

MessagingSecure internal communication channel between the client and your Customer Support/Compliance department. Attachment of files. Automatic screening of attached files using anti-virus software. Search of messages by categories. Prioritised alerts for compliance requests. Alerts about change of tariffs or T&Cs.

-

Two-Factor AuthenticationSystem login and confirmation of outgoing transactions with a one-time password provided via push messages in mobile app, Google authenticator, SMS or a digipass.

-

SettingsSelection of multiple languages, setting additional fixed password for login, view of last logins sessions (time, date, IP and the city).