iorys Ledger

A cutting-edge ledger and back-end with all required

functionality for any modern bank

or a Fintech

functionality for any modern bank

or a Fintech

Flexible White-Label Business Models

-

Rental of the banking platform as a Service

Enables you to rent the platform in the cloud with zero expenses on IT resources. -

Ownership of license with annual support

Investment into a cutting-edge platform that can be installed on your premises and that becomes an equity of your company.

Features

-

Proven massive scalability with banks and payment firms

-

Constant updates and introduction of new functionality

-

AML/KYC scoring, PEP & Sanction lists checks

-

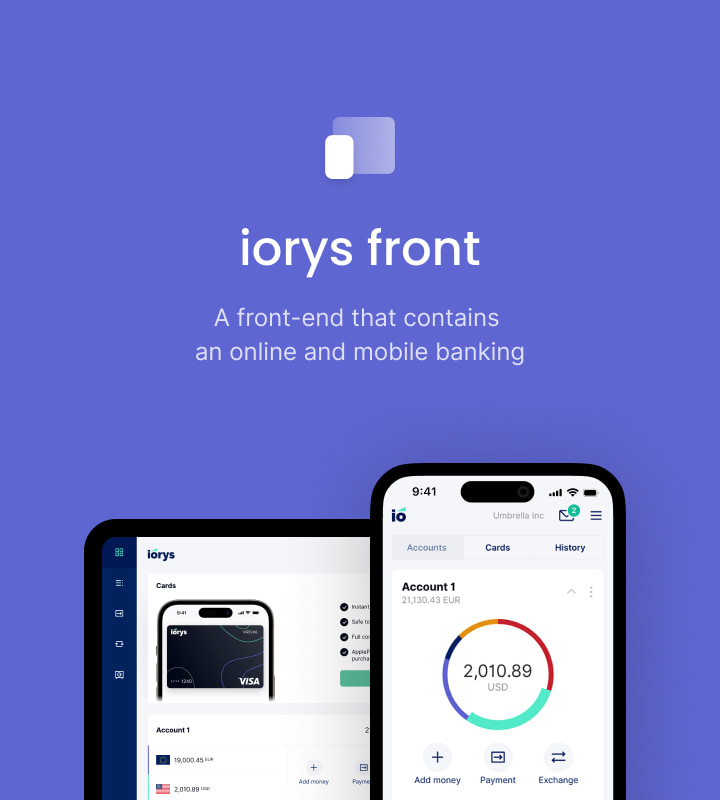

Clear and simple UI/UX

-

European data centers

-

Fast development of tailor-made features

-

Multi-currency & Crypto currency

-

Service level agreement

-

Open Banking: PSD2 Compliance

-

Quick deployment

-

Reporting

-

Flexible customization

Platform architecture

Business functions

Back-end modules

-

CRMView and management of the entire database of existing and previous clients. Storage of collected KYC for clients and transactions. Account holder/signatory relationship management, mailing list management.

View and management of the entire database of existing and previous clients. -

TariffsTailor-made tariffs for customers or group of customers. Creation of new and amendment of previous tariffs. Programming of any fee schedule logic. Forex exchange updates via an API or setting the rates manually.

-

Correspondent (Nostro) Account ManagementView of all nostro accounts with actual balances. Download of account opening/closing balances. Liquidity management via an API or batch files. Management of internal and external pool accounts.

-

Accounting & ReportingView of the balance sheet, as well as Profit and Loss statement. Profitability reports based on certain agents, group of clients, products. The module contains multi-currency accounting, day balance closing/opening, and other functions that meet most regulatory and audit requirements.

-

Access RightsRestriction of access rights in the back-office for certain staff members (read-only, limited or full administrator access). Logging of all actions within the back-office system.

-

Two-Factor Authentication StaffAdditional security for prevention unauthorized access using 3rd party access codes. Staff members may receive one-time passwords as a push message in a mobile app or by SMS.

-

Loans and Trade FinanceAll the necessary tools for loan management, including loan opening, schedule modeling, administration and closing. Loans can be with fixed or variable interest rates, which are calculated automatically. Collateral administration, provision accounting, loss events registration and other loan management tools. Reminders about due amounts.

-

Archiving CapabilitiesAny event or detection can be archived to protect system efficiency and comply with data retention regulatory requirements. Regular data back-up for lost data recovery.

-

Data Exchange IntegrationsData management and exchange with various third-party institutions, companies and systems including financial regulators, state commercial registries, banks, CreditInfo, etc.

-

PSD2 Open APIAllowing 3rd party institutions to perform actions related to Account Information and Payment Initiation Services. Requirement of PSD2.

-

Encryption of Client DataSecurity protocols for encryption of data based on best industry practice.

-

AIS and PISConstant backup of all data on your dedicated servers.

-

Commissions for agentsInstant calculation and pay-out of commissions for sales and agents. Possibility to set multiple layers of agents.